The Coronavirus proves cities deserve more money: here’s how we could give it to them

I am very, very nervous about the finances of cities as we enter into the sixth week of the national crisis precipitated by the Coronavirus.

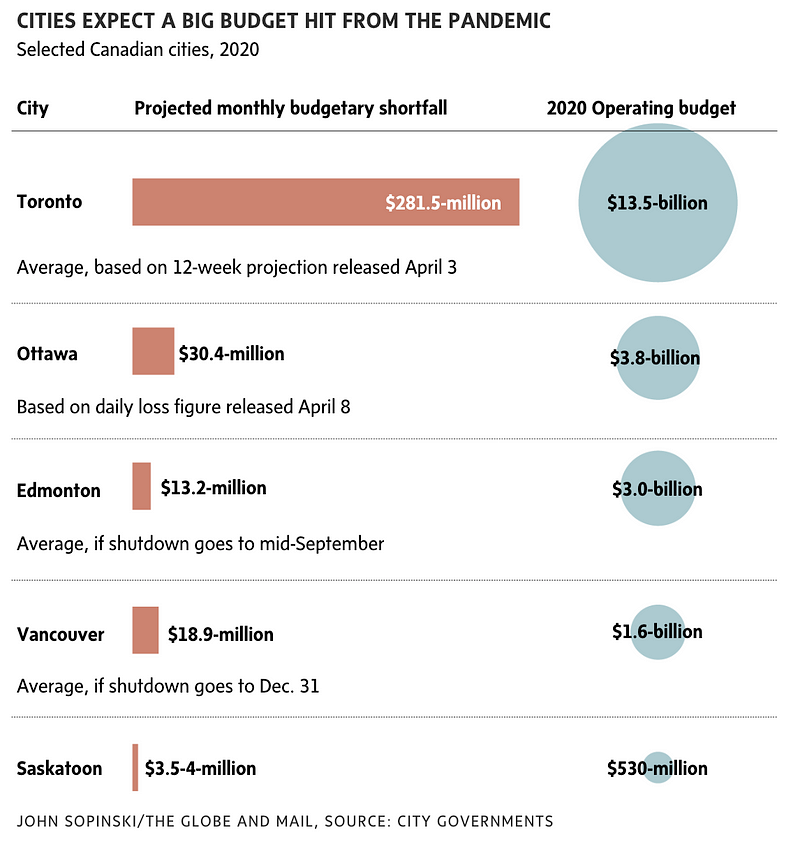

As Frances Bula wrote for the Globe and Mail last weekend, many cities are facing catastrophic budget gaps, and, despite the shoot-from-the-hip takes of the online commentariat, it doesn’t look good:

Assessing the grimness of the current situation, Bula notes

“Cities derive a large part of their revenue from a few sources — property taxes, transit fares and user fees — that are normally fairly stable. But some are worried huge job losses will mean huge drops this year. Business failures would mean another hit to city tax revenues, and permit fees for development and construction are dwindling as builders hesitate over going ahead with projects.”

And yet, the fact remains that

“Unlike other levels of governments, cities are not legally allowed to run operating deficits except on a short-term basis within a single year, to cover costs before tax money comes in. By law, they must balance their books by the end of the year.

Where does this leave cities?

The short answer seems to be: in a really, really bad place.

Now, given that we’re in the largest economic and social crisis since World War II, the likelihood of that staying the same seems low. In reading some of the comments online, I’ve been struck, I’ll be honest, at the lack of imagination that some have expressed about how we could address this challenge.

But first a little history

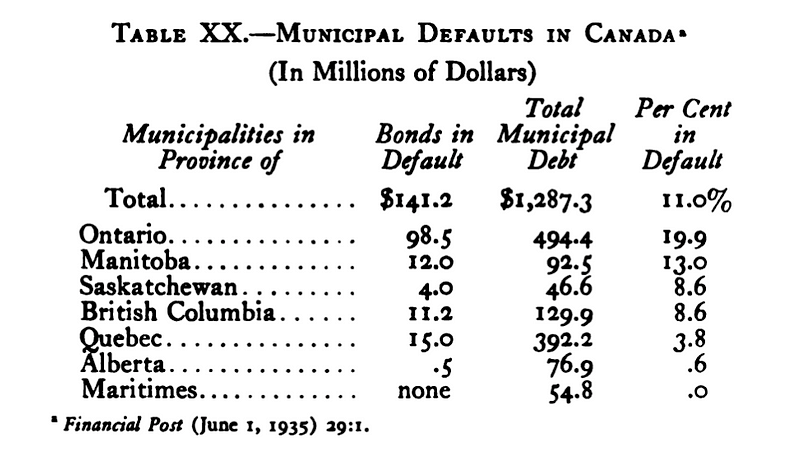

It’s important to recognise that Canadian municipal debt history since the Great Depression has been remarkably stable. Since the Great Depression, there have been very few defaults, and since 1950, apparently none at all.

During the Great Depression, however, the situation was far different. According to the 1936 study of A.M. Hillhouse, 163 of Canada’s 4,286 “taxing units” were in default. As Marc Joffee notes, most of these entities were school boards or other smaller taxing units, but there still were sizable cities (including York, Windsor, and Burnaby, all with interest/revenue ratios in the 24–26% range — contrast that to Vancouver’s 2.2% today) that were in arrears by the mid-1930s, in particular due to a rush of borrowing in the 1920s.

The defaults peaked at 11% of total municipal debt in Canada, and this occurred at the same time as Alberta was undergoing its own default proceedings on about one-third of its provincial debt (a state that remained in place until 1945). A huge part of this crisis came from the fact that around in Ontario, the epicentre of the debt crisis, fully half of all municipal taxes were in arrears in 1934. Wherever municipal revenue fell, demand for new services increased: cities were performing numerous different kinds of relief services for local residents, at the same time as many (mostly newer suburbs) were also trying to pay off building sprees in the booming 1920s.

Many cities ended up receiving federal and provincial assistance (some as high as 85% of their total expenses), but this work also ushered in a wave of new municipal innovations (and provincial paternalism): the Ontario Municipal Board, the British Columbia Department for Municipal Affairs, and many other institutions of municipal oversight were all created during this time as a direct result of the crisis.

So, in short, we know that many municipalities in Canada stopped being able to pay their debts in the 1930s. The lack of fiscal assistance at the federal and provincial level, particularly at the start of the Great Depression, combined with varied and still developing institutional structures (e.g., ‘growth pays for growth’) for municipalities, created a perfect storm that resulted in a need for both fiscal and political intervention by the provinces and, in some cases, the Government of Canada itself.

What can we learn from this?

- Beware negative feedback loops — So many of the cities that defaulted, and every single one that struggled, faced intersecting crisis of increased spending (i.e., local relief programs for the unemployed) and declining revenues. Both of these circumstances lasted long enough that larger financial capacity was needed than what an individual community could bare.

- The longer we wait, the harder things become— The delayed response of all governments to the crisis led to untold human misery in Canada, and, in the municipal case, ended up resulting in more difficult interventions for senior orders of government, sometimes in the form of direct management.

- Working with what we have — Most cities in Canada in the 1930s had relatively simple governance structures, and even more basic financial planning. Today, we have far more capacious institutions that can handle complex financial work; all we have to do is look at one of the most successful municipal institutions in Canada, BC’s Municipal Finance Authority.

- Crisis breeds creativity — many institutions and practices we use today grew out of this crisis. The Rowell-Sirois Commission, late though it was in the Depression, made recommendations, like equalization payments and nationalized unemployment insurance that we enjoy to this day.

History doesn’t repeat itself, it just rhymes

The COVID19 crisis has echoes of the Great Depression almost a hundred years ago, since it was that crisis that precipitated the advent of more muscular federal and, soon after, provincial government responses to social and economic problems. Innumerable programs we depend on every day emerged out of the recognition of additional necessary government support — and, correspondingly, the resources needed to provide this support — were critical.

If we look at the current state of municipal finances today, it seems readily apparent that a similar crisis of immediate need and medium-term declining resources are upon us.

Where do we go from here?

The reason that municipalities face a unique form of financial crisis during COVID19 are three-fold:

- They depend on a very narrow stream of revenues (mostly property taxes and user fees) that are not responsive and are their only means of meeting their expenses

- Those limited revenue streams are being eviscerated by the immediate crisis, and, are going to be identified as a potential strangling factor in the recovery;

- Their spending needs, particularly when we look at the eventual economic recovery, are only going to grow in the near term.

The intersection of these forces necessitates a broad range of interventions from both the federal and provincial governments that enable cities to weather the current storm, and then enable them to rebuild their financial health post-crisis.

1. Short-term Grants and Wage Subsidies

Cities are bleeding cash. There are concerns that they will not be able to make needed payments, such as transfer school taxes, paying regional transit providers, and even payroll if things continue as they have by the end of the year. A key aspect of this is the deferral or reduction of property taxes — cities were expecting an influx of revenue this month, which will not come, and will likely be much, much smaller than expected when it does.

The Federal and Provincial Governments should provide an immediate cash transfer to the cities to help cover operational expenditures and prevent the drawing down on capital reserves, which will be critical to the economic recovery. This would be a large undertaking, but money could be transferred quickly through existing Federation of Canadian Municipalities mechanisms, and should also involve wage-subsidy access for a portion of city workers (as we have seen with transit agencies across the country, this would be lifesaving for some institutions). Immediacy here is critical — as we hear some cities talking about having sell off long-term assets, like land for future social housing, just to keep the lights on. This would have disastrous long-term consequences.

2. Allowing Operating Deficits

Cities are not allowed to run deficits in Canada, and, announcements in British Columbia this week notwithstanding, this is clearly a massive problem in the context of COVID19. The perfect storm of declining revenues, limited revenue streams, and growing expenses make a balanced budget either a practical impossibility, or an exercise in human misery.

B.C. has been the first province to come forward with notice that cities will be allowed to run operating deficits in 2020, but the fine print is more particular:

- The deficit can only be run for one year and the budget must be fully balanced by the end of 2021;

- Cash can be taken from the capital reserves for infrastructure projects, but must be paid back (without interest, though, thankfully).

A more ambitious approach would be to allow a longer window of deficits (say 3–5 years), with a coordinated debt issuance at the provincial or regional level (e.g., through the BC Municipal Finance Authority) that could cover a reasonable amount of operating expenses across cities for the COVID19 period and any subsequent recessionary period post-crisis. This last piece is critical, since many cities may not have a rebound in property tax revenue until several years from now. They need to be kept afloat until revenues return.

3. Municipal Low or Zero-Interest Borrowing Facility from the Bank of Canada

If cities are going to be borrowing both in the short and the long-term, there’s one institution perfectly positioned to assist them: the Bank of Canada. As the crisis has grown, the Bank has expanded its activities to lend more aggressively not only to its traditional constituents, chartered banks and other financial institutions, but also the provinces, with its Provincial Money Markets Program (PMMP).

Bank of Canada

Bank of Canada

The idea behind these purchases is that the Bank is buying provincial debt issuances at a competitive rates in order to ‘buy down’ provincial borrowing costs. As many have noted, particularly in the US, there’s been a frenzy of investors moving to sell off their subnational debt holdings — “munis” — as their need for cash increases, and demands to borrow skyrock across the whole spectrum of subnational borrowers, from states and provinces, all the way down to school district. Rates are being driven up as a result. The Bank is wading directly into this fight in order to buy short-term provincial debt at more reasonable rates, and therefore ease the pressure on the provinces.

For municipalities, the structure could be largely similar, and the Bank has already indicated that they are willing to exercise their powers to buy local government debts. An ideal structure would probably contain a few pieces:

- Short- and Medium-term “bullet bond” issuance, on a 3–5 year scale, both from individual communities and coalitions of communities that would allow them to regain some of their fiscal health before they start paying back;

- Coordination with provincial municipal authorities to provide support for long-term financial planning, and, in some cases, underwriting or other support to make these loans fully digestible, for example, for smaller communities;

- Interest rate buy-downs, or conditional relief, from the federal government — for example, if a city (say a resource community in Alberta or Newfoundland and Labrador) was still in a fiscal crisis at the end of the repayment period.

4. Large-scale Infrastructure Stimulus

Everyone knows that the end of this crisis is going to require substantial fiscal stimulus. Provinces are already announcing funds set aside for recovery at the end of the crisis, and the Government of Canada has said that they plan to also spend significantly. Others than me are in a better position than I am to say how much this should be, or what avenues it could take, some key principles should be:

- Focusing on solving pre-existing infrastructure gaps — This means things like advancing the National Housing Strategy, acting on long-standing transit projects, investing in Indigenous infrastructure needs, and continuing the push to decarbonize our economy and adapt to the challenges of climate change;

- Building complimentary, parallel programs — Programs that address challenges like the national skills gap, the needs of a Just Transition, and creating a truly diverse, inclusive, and respected workforce, should also be kept on the table.

- Buying land — As much money as the government spends, it will not be able to save every homeowner or business. Even if land-prices don’t decline dramatically (and especially if they do), local governments should be ready to step in and buy land.

- Recouping value — as many have argued, large-scale infrastructure spending generates value, and if public dollars are going to create a windfall, then some of that should be directed back to the public purse. Whether that’s a Land Value Capture, new taxes, or shared revenue (or equity), there are plenty of ways to ensure that investments generate a clear ROI back to the originators — us.

5. Long-term Revenue Expansion for Cities

Urbanists have been saying this for decades, whether with regards to the federal Gas Tax Fund, the limits of property taxes, or the growing demands on all local governments, but cities need a new fiscal framework. They are on the front lines of some of the most pressing challenges facing contemporary society, whether the opioid crisis, climate change, or housing affordability — they have to deliver on complex problems every day and yet continue to have to beg or borrow just to accomplish even their most baseline tax.

A new municipal regime in Canada will take time to develop, but should include a mixture of new taxation powers (e.g., payroll, excise, land-value, income, and others), new regulatory authorities, and new governance mechanisms across Canada.

Starting with the getting them the money to save lives today, however, is undoubtedly the best place to start.

Sign up for George Patrick Richard Benson

Strategist, writer, and researcher.

No spam. Unsubscribe anytime.