With the uncertainties of BC's election behind us now, and not only a new cabinet, but a new, combined energy and climate ministry in place, now is a great time to return to the final part of my series on the energy transition in BC.

Clean Energy CanadaClean Energy Canada

Clean Energy CanadaClean Energy Canada

As I covered extensively in part two of my series, aspects of the BC energy system - particularly mega-projects like Site C and their relationship to the oil and gas industry - have always been contentious. Everyone comes into energy policy with their own prior knowledge, assumptions, and hoped-for outcomes. On the whole, BC has consistently and reliably met residents' energy needs, but due to both a changing context (e.g., climate change-inflected droughts), the moral and legal imperatives of reconciliation with Indigenous peoples, and forward-looking ambitions (e.g., industrial growth, climate action), we must adapt our system accordingly.

In this final part of the series, I'll explore some of the final historical developments that have brought us to this moment, as well as some of the present policy and infrastructure context, including

- The 2021 BC Hydro Integrated Resource Plan (IRP) that started to integrate considerations and needs raised by CleanBC, but which needed an update in 2023 before it was deemed fit for purpose.

- The BC Hydro Call for Power that aimed to fulfill, post-2023, the new energy needs that had developed as a result of climate action and major industrial developments.

- The Indigenous response to the call for power and the policy and other ideas they've raised to further ensure beneficiary outcomes vis-a-vis reconciliation as part of BC Energy Policy.

- The 2024 release of the BC Energy Strategy and work still to be done to realize some of its broader intentions.

I'll end with some reflections on what I have learned during this whole project.

What You Need to Know

- The 2021 Integrated Resource Plan (IRP) from BC Hydro came out around the same time as CleanBC and faced a lot of criticism for what were felt to be low-ball estimates on future energy demand. An eventual 2023 update would increase 2030's expected energy needs by 4,300 GWhs.

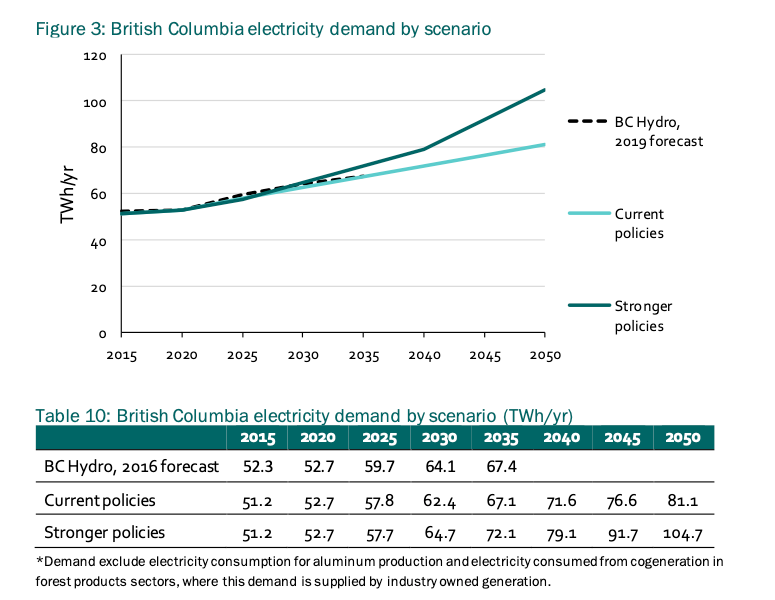

- New technical modelling from Navius showed somewhat similar results to prior MKJA and Clean Energy BC projections and that stronger policies could shift 2040 demand from as low as 70 GWhs to as high as 100 GWhs by 2050, but these were not well-integrated into BC Hydro's planning

- Navius, like prior analyses, showed that in a high electricity demand scenario, gas production was what led to load growth, with "70% of the incremental demand [coming] from natural gas production. Another 20% of the incremental demand comes from the LNG sector [by 2050]."

- At the same time as a modestly updated IRP was released in 2023, BC Hydro also came out with a 10-year capital plan, which set out goals of spending over $36 billion on upgrading and building new transmission and distribution infrastructure and, most importantly, on new generation capacity.

- The Capital Plan included meaningful considerations around Indigenous benefits from the Call for Power. However, groups like the First Nations Energy and Mining Council still have ideas on how it could go further.

- The Powering our Future document from the BC Government, released just before the election, did not lay out any particularly bold proposals, but did signal that BC would likely have a full-on energy plan that would integrate climate policy, BC Hydro's system, and future resource development under development in 2025 - the results of which remain to be seen.

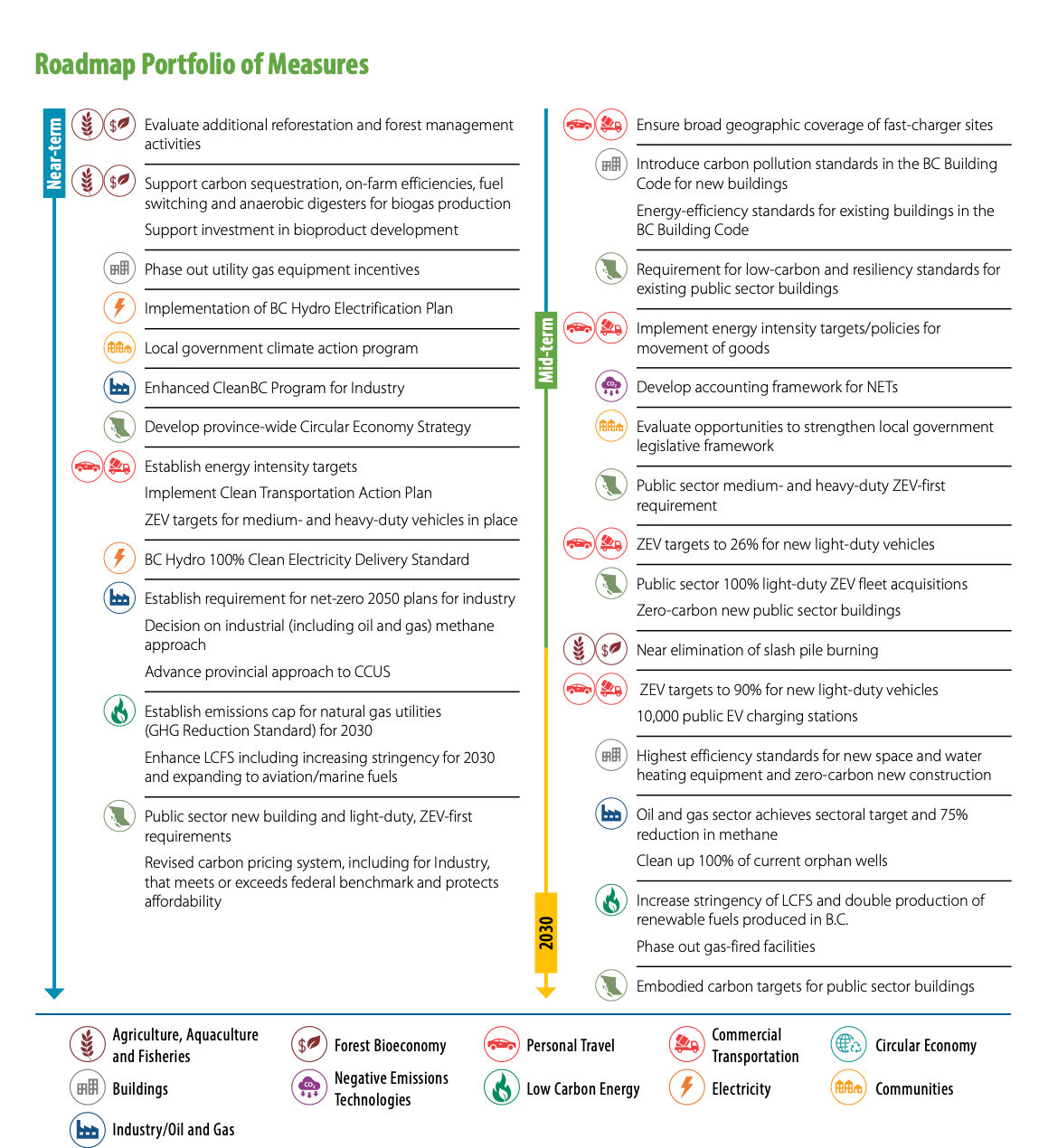

CleanBC the 2021 Integrated Resource Plan, and the Changing Landscape of Utilities

In 2021, BC Hydro released its next IRP, now integrating a strategic view of CleanBC, but caught in a challenging context vis-a-vis timing. The initial version of CleanBC was released in 2018, but in 2021 (a few months before the IRP), the BC Government came out with the Roadmap to 2030, the longer-term, much more detailed version of actions that would, per the name, get BC to its 2030 targets. The Roadmap is, at present, BC's strategic approach and mid-term plan, to deal with both climate mitigation and adaptation.

CleanBC

CleanBC

Without getting into the nitty-gritty of the roadmap, it's important to say that it lays out the pathway from 2021 to 2030, integrating a huge range of plans and activities to meet the province's legislated target.

Because of the timing, though (and remember, creating an IRP is a gargantuan task that takes years - and BC Hydro hadn't already done one for years), the roadmap's actions weren't as tightly baked into the IRP as anyone would have wanted. The resource plan drew on what became known as the "phase one" actions of the 2018 document and acknowledged but did not model, what was now starting to emerge in the roadmap to 2030.

This resulted in strikingly staid language from BC Hydro, like this:

Where possible, the report identifies Low Carbon Electrification (LCE) or fuel-switching components within the load forecast which capture specific policies and measures contained in the CleanBC Plan, such as the Zero Emission Vehicles (ZEV) Act. This report also includes the results of an accelerated electrification scenario, which estimates the total demand from electrification if provincial GHG reduction targets are achieved.

Without the time to fully digest and integrate the new roadmap, and still smarting from longstanding critiques of over-estimating generation needs a la Site C, BC Hydro's IRP application assumed 1.0% compound annual growth (CGAR) over the next twenty years in their reference scenario.

They weren't off base in a historical sense: in the US, for example, electricity demand grew by 0.5% on average between 2004 and 2024. But there, like here, things were changing, as the Centre for Strategic and International Studies wrote earlier this year:

The North American Electric Reliability Corporation (NERC) forecasts gigawatts (GW) of winter peak demand growth over the next 10 years. Two years ago, that figure stood at roughly 40 GW of forecasted growth. Individual reporting from utilities and grid operators portends accelerating growth. ERCOT, the Texas grid operator, recently issued a long-term demand forecast showing 62 GW of peak demand growth by 2030. PJM, the grid operator for 13 states in the mid-Atlantic, forecasts 25 GW of peak summer demand growth by 2034. In the Pacific Northwest, 8.5 GW of summer peak demand growth is expected, representing a 30 percent increase, over 10 years. With these figures in mind, every expectation is for NERC’s next long-term forecast [due in December of 2024] to be revised further upward.

Understanding the assumptions

The modelling for the 2021 IRP was trying to thread the needle of the reality of both changing industrial needs and climate policy and drew on a report by Navius Research, which does a lot of BC and Canadian economic and climate analysis.

The Navius-led "Electrification Impacts Study" tested a series of fundamental assumptions that were felt to be "firm," and then layered in progressively intense possibilities to test how much more electricity might result from these stronger climate policies. Some of their most important firm assumptions were:

- The carbon tax rose to $50/tCO2e by 2020.

- That electricity transmission to natural gas-producing regions of BC, including the Dawson Creek and Chetwynd area and the Peace region, continues in line with both BC Hydro planning and BC Government support for LNG production.

- That a range of renewable natural gas (RNG)-focused policies, such as landfill gas capture, would remain in place.

- The proposed cap on gas utility emissions would move forward (a 10% decrease by 2020, and 20% by 2030 in a stronger policy scenario).

- That the Energy Step Code (this was before the Zero Carbon Step Code) would remain in place, with, interestingly, an assumption that all new construction would be "net-zero ready" by 2035, not 2032, as the code actually says.

- No provincial retrofit policies are created in a baseline scenario, with a 1.5%/year turnover of pre-2010 buildings imagined in a stronger policy scenario. (Notably, this is still anemically low compared to what the Pembina Institute has estimated would be needed - 4.5% per year from 2021-2025 alone)

- Additionally, in a stronger policy scenario, heat pumps are required for space and water heating after 2035 - less aggressively, it should be noted, in what was subsequently proposed under the Highest Efficiency Equipment Standard (HEES) in 2023.

From these and other baseline assumptions, they then layer on a range of higher-intensity policy rules, and assumptions about how much lower the costs of core technologies could be. The mixture of these assumptions and their application to particular sectors creates a unique view of where demand for electricity spikes.

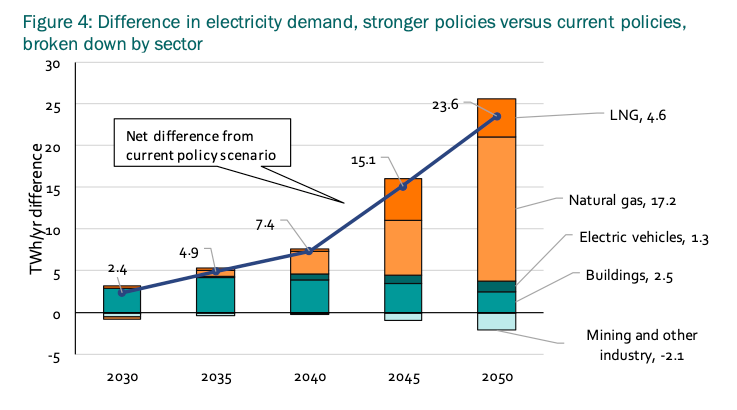

A few things from their analysis stand out to me:

- To quote Navius (pg 36), in a high-electricity demand scenario, driven by climate policy, "70% of the incremental demand comes from natural gas production. Another 20% of the incremental demand comes from the LNG sector." [emphasis mine] This would represent a total of 21.8 TWh/year of new electricity by 2050.

- Low costs for electric vehicles only add another 1.3 TWhs of demand by 2050 (and this model completely ignores the potential for vehicle-to-grid demand management strategies), but this is completely out of step with the public perception of how EVs are impacting the grid, which is that they are one of the dominant stressors on the grid today.

- Navis projects a proliferation of industrial heat pumps in BC, but these only supply 16% of all industrial heat in BC by 2050, with electric resistance still supplying another 12%. It's unclear to me why the report seems to characterize heat pumps supplying sub-100C temperatures as a problem, given that that's the most mature instance of the the technology.

- While building electrification does indeed spike demand, particularly in the 2030s and 2040s above lower-ambition climate scenario, by 2050, the difference is only 2.5 TWh (out of 81 TWh), presumably because there is both as natural growth in the use of these systems due to more attractive economics, and the relative increase in electricity created by other sectors (especially gas production).

As Navius concludes their report:

Of the dynamics tested, BC’s long-term electricity demand is most sensitive to the strength of climate policy. In 2030, the difference between current policies and stronger policies is relatively small. The electricity demand forecast ranges from 62 to 65 TWh/yr. By 2050, the difference is much larger. In response to current policies, electricity demand grows to roughly 81 TWh/yr, whereas with stronger policies, it grows to almost 105 TWh/yr, a difference of 24 TWh/yr (+29%).

And, in a bit of an anti-climactic outcome, the results mirror, with both more conservative outcomes and assumptions, the results of other models:

- The MKJA study estimated 86 TWh/year by 2030, and 112 TWh/year by 2050, in a high climate ambition, high gas price scenario, with a compound annual growth rate of compound annual growth rate (CAGR) of 1.98%.

- The Clean Energy BC whitepaper estimated~125 TWh/year by 2050, based on a 100% increase (on an assumed 62,597 GWh/year of electricity net of losses in 2017) by 2050, with a CAGR of 2.1%.

Despite the alignments in these estimates, and the growing momentum on climate policy, BC Hydro's original 2021 IRP still opted for what amounted to some of the lowest possible estimates of new demand.

Frustrations and Toward Integrated Planning

There was considerable gnashing of teeth over the IRP's framing of future demand, and partially in reaction to this (and other intra-governmental movements), the BCUC directed both BC Hydro and FortisBC to do an integrated energy modelling project to compare their assumptions around what GHG reduction targets meant for demand within the entire energy system.

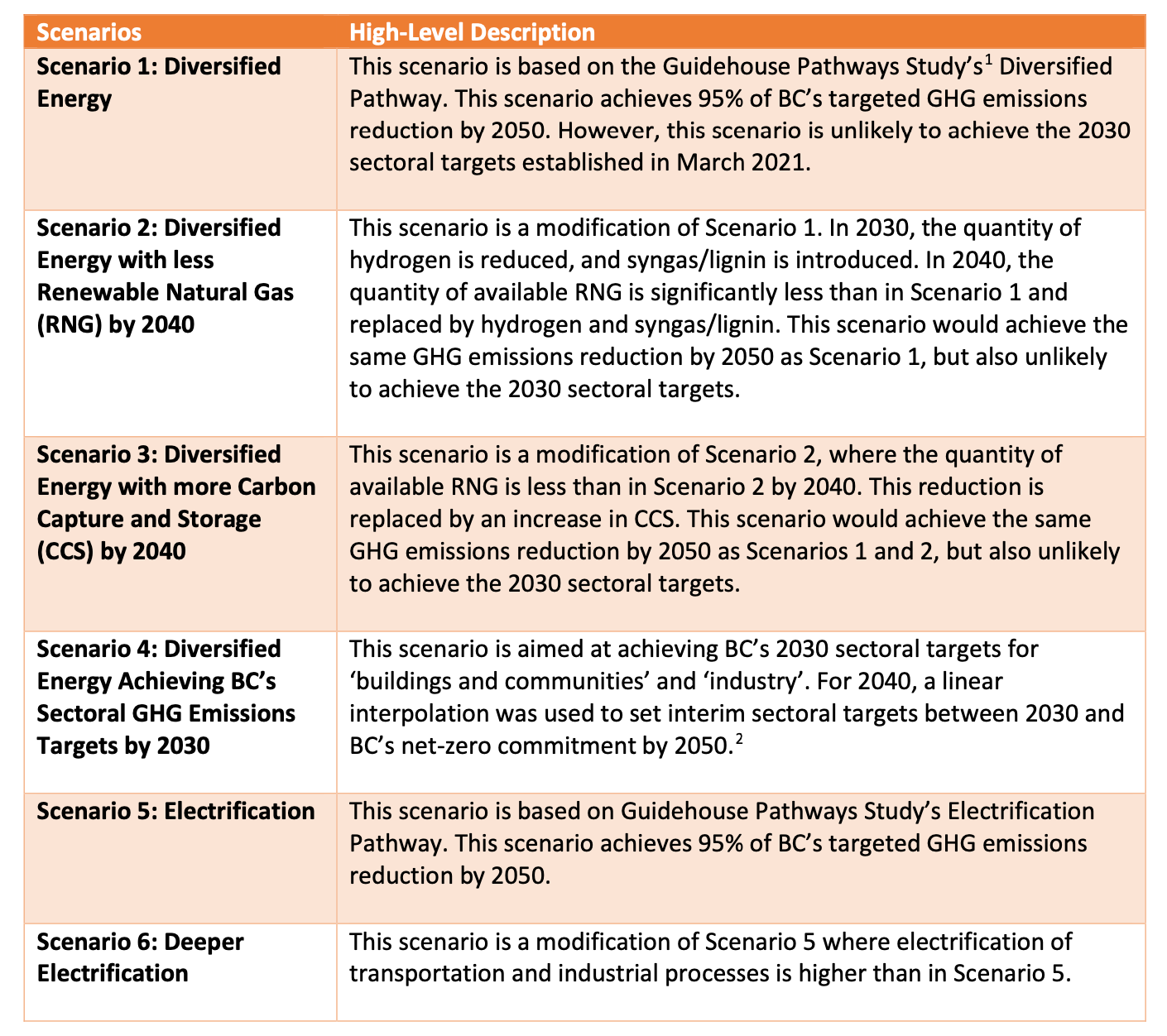

They undertake five scenarios of analysis, wherein BC Hydro combines its two of its models with three Fortis scenarios:

For those in the know, the results weren't exactly shocking and somewhat aligned with the prior electrification studies, but they did produce one particularly amusing outcome: every single Fortis scenario assumed more electricity need than what BC Hydro had planned for.

But, overarchingly, the forecast was still out of step with some of the others in contention, including MKJA, Clean Energy BC, and the 2021 Navius model, all of which had high climate ambition scenarios consuming greater than 100 TWh of energy per year by the 2040s.

In what feels especially frustrating, the BC Hydro Accelerated Electrification Scenario is only modestly above what Navius had projected in their baseline scenarios of BC's existing, legally implemented policies.

Beyond its already-high stakes as the first BC Hydro plan since 2013, the first one fully under the BCUC since 2008, and the first under the new CleanBC Roadmap to 2030, the 2021 IRP also faced another fundamental complexity:

Amidst a still ongoing approval process for its 2021 IRP, in 2023, the BC Government approved the Environmental Assessment of the Cedar LNG Project and also announced the intention to develop a new "climate-aligned energy framework" to create a more effective regulatory and policy environment for energy in BC, ensuring a triple commitment to reconciliation, economic development, and climate action through one document.

BC Hydro and basically everyone else recognized that the current IRP was not going to reflect even near-term circumstances with these changes, let alone provide an effective pathway for longer-term energy planning. Additionally, around the same time, the BCUC also adjourned proceedings on a Fortis proposal for LNG storage on the Lower Fraser River, another sign that the BC energy landscape was rapidly evolving.

Because of these ever-changing developments, BC Hydro was given more time to develop a "Signpost Update" to the 2021 IRP, which basically refreshed it with new policy and economic context, as well as additional policy considerations that the BC Government brought out in the following year.

An Updated Perspective

After almost another three years of work, and building on Hydro's already-approved capital plan announced in January, on March 6th of 2024, BC Hydro received its final approval for the updated IRP. The results, while understated in their presentation, are dramatic when put side-by-side, as this great analysis from Power Advisory LLC shows.

The clincher was, as many had argued since 2017, that BC Hydro was going to need significantly more energy by 2030 if all ongoing trends continued. As Hydro wrote in their final 2023 update,

Taken together, in fiscal 2030, relative to the April 2023 Accelerated Reference Energy Load Forecast, and the 2021 IRP Base Resource Plan show a total shift [i.e., increase] of approximately 4,000 GWh.

Because of these upward shifts in demand expectations, BC Hydro committed to the acquisition of 3,000 new GWhs worth of energy to supply demand by 2029, as well as trying to squeeze another 700 GWhs out of existing facilities prior to that date. This, as we'll cover in a moment, is what was baked into the Call for Power.

Importantly, in light of the ever-changing assumptions that Hydro and others had to include in these models, and over and above their regulatory obligations, Hydro committed to getting into an 18-month planning cycle where they would develop a "living IRP." We're expecting to see the results of this first run at it in early 2025 – ever the optimist, I hope that these subsequent plans will grapple more directly with the likelihood of continuing high demand for electricity, not only as a result of climate action but increased industrial and consumer demand across the board.

Delivering via the Capital Plan

As if the development of the IRP wasn't unwieldy enough, BC Hydro also had to release a staggeringly large capital plan at the same time, to deliver on the now-needed new generation and network upgrade it and others were protecting. It's the combination of the two that I think gives us some of the clearest mid-term thinking on what BC's decarbonization and electrification journey is going to look like. Both the IRP and the capital plan offer some strong rhetoric and some new observations on this transition in both the why and the how, such as:

- Efforts both to halt climate change (i.e., decarbonization) and to address its impacts (i.e., energy resilience, more resources in case of drought, etc.) will mean BC needs considerably more energy, specifically electricity.

- Electricity today is something of a "junior partner" in the province's energy mix, with only about 20% total share today, but that will change in the future.

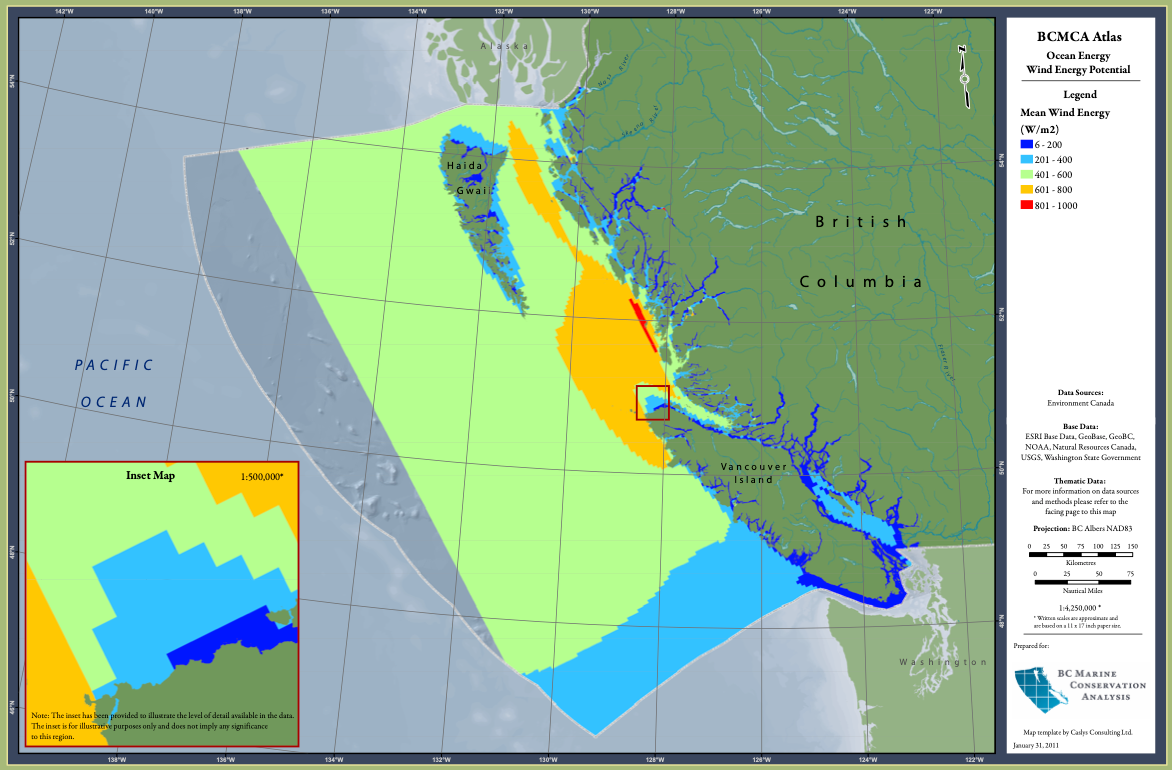

- Wind and solar, while currently providing an infinitesimal part of BC's energy today, are going to play larger roles in the future.

- Electricity will be a central pillar of BC's competitive economic advantages now and in the future - this is equally true on whatever side of the "resource question" that you're on. As Clean Energy Canada recently said, new LNG facilities alone could require the equivalent of eight more Site C Dams; that's not counting new demand from EVs, electrified buildings, hydrogen production, or new manufacturing and data centres.

So no matter what we do, we need more electricity and, as the IRP says, we need to use it all more efficiently.

The BC Hydro 10-year Capital Plan is one massive part of how we're going to realize all of these goals. The plan's objectives, while mildly stated, are ambitious and speak to a significant role, not just for BC Hydro, but for the province's entire electrification supply chain - the general contractors, the tradespeople, the engineering design firms, the energy modellers, and many, many others - in delivering not only climate action but a massive economic development boost.

It will spend $36 billion across its own systems and through procurement for new generation, generating an estimated 10,500 to 12,500 jobs, on average, annually. All of this is paid for within the crown corporation's existing debt and does not involve any taxpayer money.

The 10-year capital plan accordingly then aims to do three major things in an integrated way:

- Help deliver both the CleanBC climate plan and the StrongerBC economic development plan, by providing sufficient amounts of high-quality, affordable electricity for everyone who needs it.

- Reinforce BC Hydro's existing generation and transmission systems to better enable customer connections (particularly important for large industrial clients, like LNG) and meet expected load growth.

- And sustain the system over time through effective stewardship and capital planning to keep BC's residential and commercial electricity rates (among the lowest in the whole world) low for existing customers.

Because it came out before the final signpost update to the IRP, the capital plan is pretty high-level, but between the two of them, the buckets of work are:

Invest in Existing Systems

The capital plan will spend $21 billion over 10 years in existing areas across the system. This work on "sustainment" will include major transmission upgrades and reinforcement, increasing the strength and volume of connections in Metro Vancouver, Vancouver Island, and the North Montney region. This will include things like wooden pole replacements (crucial for wildfire safety), where the plan is to upgrade 100,000 individual poles, and over 25,000 transformer upgrades to enable higher capacity.

To meet the expected 15% increase in new demand by 2050, the plan will spend $10 billion on net new local infrastructure. This will include area-specific investments in things like substations (like at Scott Road in Surrey, at Goldstream in Colwood) and a major commitment to massive build-outs of infrastructure for the North Coast, where they talk about "unleashing our shared economic potential."

Lastly, the plan envisions $5 billion to support new customer connections for the projected 180,000 new residential connections expected in the next ten years. This will mean building 50 new distribution feeders, over 250 kilometres of new underground distribution infrastructure, and 50 projects already in progress to increase transmission capacity.

Programs to Save Energy and Use It More Efficiency

The capital plan, understandably, only talks about the things that BC Hydro is going to build. The IRP brings in another, crucial dimension: the many programs that BC Hydro already operates, and the new ones it will create, to help British Columbians use energy more efficiently.

This would include the sometimes (lovably) cringe work done by the Power Smart team to get people, through behaviour change, to use electricity more efficiently.

Most British Columbians know Power Smart, the program launched in 1989 to encourage them to save energy whenever they could through fun gimmicks and promotions. It's been an extremely successful demand-side management (DSM) program and is one of the reasons why Hydro has been able to avoid building more energy projects over the years. But even with its past success, Hydro is going to have to go into overdrive now.

The IRP lays out some of the decision-making on where and when DSM is better than building new electricity generation. In short, it's almost always cheaper, more timely, and more economically efficient to push for high levels of energy efficiency (as shown in the light blue column below).

The Hydro planning team ultimately selected this higher (but not the highest) level of energy efficiency investment assumptions to guide the 2021 updated IRP. As they write at the bottom of the plan, they are not pursuing the highest possible efficiency programs, since this can result in higher costs for consumers as a result of complex utility economics.

What they do have planned as part of their near-term actions is to:

Advance the ramp-up from Base Energy Efficiency to Higher Energy Efficiency to achieve approximately 1,800 GWh/year of energy savings and 300 MW of capacity savings by fiscal 2030 while maintaining the option to ramp up to Higher Plus Energy Efficiency in future years to achieve approximately 1,950 GWh/year of energy savings and 350 MW of capacity savings by fiscal 2030.

Pursue voluntary time-varying rates supported by demand response programs to achieve up to approximately 220 MW of capacity savings at the system level by fiscal 2030.

Advance the timing of the implementation of programs, technology and product offers for customers to facilitate an earlier understanding of the achievable capacity savings and to maintain the flexibility to ramp up in response to future needs.

Advance industrial load curtailment to achieve up to approximately 100 MW of incremental capacity savings at the system level as early as fiscal 2025.

Pursue a combination of education and marketing efforts as well as incentives for smart-charging technology for customers to support a voluntary residential time-of-use rate to shift home charging by 50 to 75% of residential electric vehicle drivers to off-peak demand periods to achieve up to approximately 170 MW of capacity savings at the system level by fiscal 2030, with a planned amount of 100 MW by fiscal 2030.

These are only the accelerated actions, with much, much more DSM to move forward as part of the larger plan and in alignment with local governments and programs like Better Homes BC.

Building New Generation and Storage

The announcement that BC Hydro would procure new power - something that felt unthinkable even three or four years ago, with the morass of Site C - has largely stolen the show over the past few months. But BC Hydro is doing something that many in the utility world will look on with great excitement. As part of their accelerated actions in the 2023 update to the IRP, they will also "Advance utility-scale batteries to enable BC Hydro to achieve approximately 50 MW of additional capacity as early as fiscal 2027 and up to 600 MW of additional capacity by fiscal 2030."

Ultimately BC Hydro views its resources through a holistic lens of energy production options and capacity options and the plan invests in both.

All of this will take shape through the 2024 call for power, for which BC Hydro received over three times – more than 9,000 GWh – more than its target for the initial call. It's unclear what the breakdown is in terms of potential supply by project, but of the 21 submissions, 70% of the applicants proposed wind projects, 20% proposed solar, and 10% included a range of biomass and micro-hydro.

The final contracts are expected to be awarded by December 16 of this year.

I think what many of us watch with great interest is how this work will interact with and, ideally, support, the already-in-progress Indigenous energy renaissance in BC.

The Indigenous Opportunity

The BC First Nations Energy and Mining Council (FNEMC) wrote a fantastic report in 2023 after the announcement of the call for power, laying out a "framework for advancing Indigenous economic opportunities" as part of the increased energy needs that the BC Government is now forecasting. This builds on the work of numerous Indigenous leaders in energy, such as Chief Patrick Michell of the Kanaka Bar First Nation, and Clean Energy BC Executive Director, Kwatuuma.

The TyeeZoë Yunker

The TyeeZoë Yunker

As part of implementing responsibilities on reconciliation as part of BC's implementation of the UN Declaration on the Rights of Indigenous Peoples (UNDRIP), the Council said that it would work with First Nations to design a call for power that "includes a minimum First Nations ownership in the project" (set at 25% equity or ownership stake) and a variety of processes to make that commitment real.

As the Council wrote later,

[T]he Province and BC Hydro are developing a more thoughtful approach to reconciliation than displayed in the past. However this approach can and must be strengthened in particular given the following: (a) First Nations’ repeated attempts to conduct the necessary conversations about First Nations involvement in the energy sector when the time was available to conduct those discussions properly (through the Indigenous Clean Energy Opportunities (ICEO) process initiated in 2022 as one example); (b) the findings of the Commission in its Inquiry into the Regulation of Indigenous Utilities, which could have been helpful to First Nations but that have been ignored by BC; and (c) new and important recognition and reconciliation obligations on government that have arisen and been legislated since BC Hydro’s last material power call in 2008, but which still lack actionable definition and implementation in the energy sector.

The Inquiry report is a fascinating, and indeed I would say critical, piece of reading for anyone looking to understand the changing landscape of energy governance in BC. To summarize it briefly, it establishes that the BCUC has no authority on the sovereign territories of First Nations or on Indigenous-owned utilities, but strongly recommends that both non-geographically specific Indigenous-owned and on-reserve utilities have a competent regulator that can act in the spirit of what it does.

FNEMC then lays out a four-part framework for energy development - specific to non-BC Hydro-owned generation assets and not anything else - to occur in BC in a way that not only upholds existing legal obligations but advances economic opportunity, too.

The first is minimum economic benefit requirements for ownership of the assets within the whole of the 3,000 GWh call (and not just the 225 GWhs reserved exclusively for Indigenous bidders). They recommended either:

- A 35% equity stake of all successful proponents of the Call for Power.

- An annual cash grant in lieu of equity, which is equal to the return on a notional 35%equity position.

And, in alignment with either options 1 or 2,

- An equity option with the opportunity to contribute up to an additional 15% of the common equity in the project through combinations of other funding.

The second is a self-reporting focused evaluation model, where "First Nations [can] self-report, as part of the proponent’s submission into the 2023 Call for Power," their expected benefits in a project related to (1) granted equity (and/or cash-in-lieu); (2) employment; (3) contracting opportunities; and (4) capacity building.

The third, somewhat building on the BCUC inquiry, is about regulatory discretion, to ensure that participating in the Call for Power does not disadvantage Nations later on. Importantly, they recommend that any additional costs related to fulfillment of reconciliation-related work through agreements made related to the remaining non-Indigenous 2,775 GWh within the Call for Power either be covered within the existing ratepayer structures, or directly through contributions from the government.

The fourth and final recommendation is to develop a full First Nations Call for Power. The Framework document includes mention of a carve-out of 25% of the 3,700GWh exclusively for First Nations-led projects or Utilities. Subsequent reporting only refers to "approximately" 3,000 GWh of power, so, it's unclear how the carve-out is moving forward, but it is referenced as undergoing engagement in 2023 and 2024.

Combined, these recommendations, though hardly the definitive word on Indigenous energy policy, represent meaningful directional thinking from Indigenous energy leaders in BC on what their role will be in both local climate action and the economic future of these lands.

Which way to a Climate-Aligned BC Energy System?

To much fanfare, in 2023, the BC Government also announced the start of a process to develop what they then called a "Climate-aligned Energy Framework." This eventually became Powering Our Future, a high-level document that, as one Assistant Deputy Minister described it recently, is something like a "teaser" for a future BC clean energy strategy.

As a former member of the BC Climate Solutions Council, I saw early drafts of the initial thinking on the framework and then a report back earlier at the start of 2024. If I'm honest, I was disappointed that Powering Our Future didn't have more specific things to say about major decisions that would need to be made – even as a pre-election document (and after a year of engagement) it felt thin.

But buried within the document's more descriptive aspects, are a few interesting evolutions that it highlights:

- The move towards using the concept of an "energy wallet," where costs across housing and transportation, in particular, are added up to a holistic view of how much someone is paying for energy. This can mean, for example, that while a person in a poorly insulated, all-electric house might pay more to heat their home if savings from their EV are accounted for, they might come out ahead.

- Recognizing that BC will now draw on a much wider array of renewable energy, including and especially solar and wind and that many of these would be much more distributed (even on the consumer level) than they had ever been before.

- Recommitting that BC maintain its energy independence and noting that, even with a historic drought, BC has been a net exporter over the past five-year period.

- Commitments to exploring reforming the purview of regulators, including to the BCUC on things like self-generation, but also advocacy at the federal level with regards to Alberta's use of BC transmission systems to sell to the US, while highly constraining BC's ability to sell in the Albertan domestic market.

Lastly, and of keen relevance to my and many others' work going forward, is the commitment to further engage in, what everyone assumes to be, a more detailed BC energy plan.

Reflections and Conclusion

As my entire series speaks to, BC has been caught in a political, technical, and social battle over what the future of BC's energy system is going to be for the better part of twenty years. Even among climate and environment advocates, there have often been disagreements on the exact amount and nature of the power needed for decarbonization. Among those more inclined for full-throated natural resource extraction, there's similarly been confusion about how much power is needed for what; it's a good thing to ensure that affordability is not forgotten in the drive for electrification, but it stretches credulity if, in the same breath, you also want BC taxpayers to subsidize electrification of LNG (as Shell Canada is increasingly holding the BC Government hostage over with Phase 2 of ELNG in Canada) while you complain that climate action is hurting individual consumers.

The technical nature of all of this can make your eyes bleed if you get lost in the details, but fundamentally, the entire fight over BC's energy system is not really about facts or data, it's about identity. Everyone is proposing something that will increase energy demand - it's just about what it's for, and what story will tell around why we're doing it.

Because of the potential scope of the changes we're looking at, people are unsure - and then often justifiably afraid - of what kind of place and economy we are going to be and have one day. I think about the great report BC Tech did on 'economic narratives' back in 2022, where they showed the decline of the resource sector's contributions to BC's fiscal health - and the growth of innovation-related industries.

It's clear our province is changing rapidly and I get the sense we all still haven't accepted that fact yet.

Convenient, comfortable narratives about how we can keep doing exactly what we're already doing, or that we can transform our system entirely tomorrow, are easy to buy into or get enraged at, but they do not operate on terra firma.

In reading a good chunk of the past decade's worth of energy plans and policies, I feel like I've come to understand a few fundamental features of the changes that have happened and that are coming. In many ways, this has helped shift my worldview somewhat, and these major realizations are forming points of orientation now for approaching conversations about the future of energy in BC.

Here's what I've taken away from all of my reading and learning on this issue over the past year:

Energy demand is growing everywhere around the world, with three fundamental shifts driving it:

- Rapacious demand by data centres, especially for generative AI.

- Growth in industrial demand, particularly as industrial activity changes shape and, as it has in BC for LNG and other sectors, increases in absolute terms.

- Climate policy, particularly in the effort to decarbonize the more energy-intensive aspects of our society, such as heavy- and medium-duty vehicles and large, envelope-inefficient buildings.

Despite ever-more specific models, future demand remains profoundly uncertain - especially with industrial users. In BC this is especially uncertain, with dramatic changes in our electricity needs if LNG production really does proceed, and if a meaningfully large hydrogen industry does develop here. On the latter point, I noticed that buried in the BC Hydro responses to the 2023 update to the IRP, is an updated assumption that BC will produce 53.6 million KGs of hydrogen per year by 2030, just over half of the 100 million KGs that Natural Resources Canada is projecting for BC by 2035. Clearly, there has not yet been a consensus view on the market shape for various technological transformations - BC policymakers, at the very least, need to grapple with this more openly.

Gaseous fuels – fossil and otherwise – will continue to play some role until, and likely after, 2050 - but the size of the role varies massively. The cost profiles of full electrification for some sectors, particularly niche industrial uses, are (at least for now) still too high to see a "full electrification" mandate ever realistically materialize. The fulcrum on which much of the gas question will tilt is its comparative, network-wide price compared to electricity - it is still possible, and indeed maybe even likely, that all or some parts of the gas network may enter into a ratepayer "death spiral," where declining network growth leads to a bankruptcy-inducing rise in prices and loss of customers. Another way of saying this is that: policymakers may not force electrification on customers; the market might. We need to be attentive to that possibility.

The scale of investment needed is mind-boggling – and yet is still achievable. The final cost of Site C is estimated at $16 billion (though I suspect we'll find some hidden costs later on) and that's basically half of the 10-year 2024 Capital Plan just for one asset. We spend money on big things all the time, and while we should spend it wisely, we shouldn't let big numbers alone scare us. An effective, electricity-led industrial strategy for BC is a future-proofing investment regardless of how much you are motivated by climate action.

Indigenous Peoples will play a critical role in the development of the future energy system in BC, both as a function of hard-won rights through the courts and the more recent implementation of the BC Declaration Act Action Plan. We haven't found the final formula, but we still have a chance to get this building boom right and share benefits with First Nations in a good and generous way. This won't just mean big ticket investments, but, as the idea of an Indigenous Power Authority continues to circulate, shifts in governance, ownership, and planning, too.

The governance of BC's utility and energy system will need to shift to achieve all of this effectively, fairly, and in a timely matter. This will mean crunchy changes to the Utility Act, but also a more conceptual change to how we think about utilities in what the Canada Climate Institute has called a mindset of "bigger, cleaner, smarter."

All of this will be done in an age of unpredictable, and increasing climate change impacts. From the much-discussed drought over the past five years to forest fire interruptions of transmissions to increased use of energy for building cooling in the summers, we will have to stop thinking about the past and start taking a hard-eyed view of what the future will look like.

Welcome to BC's energy future.

Sign up for George Patrick Richard Benson

Strategist, writer, and researcher.

No spam. Unsubscribe anytime.