In my last article, I wrote about both the why and the how of energy transitions at an extremely high level of abstraction. As I said then, our current, fossil fuel-based energy system is extremely inefficient and, furthermore, produces pollution that hurts us and the natural systems that we depend on.

In this (much) longer article, we'll start to get into the guts of the BC energy system and, importantly, its history over the past two and a half decades.

As the political heat on CleanBC is turned up ever-more by critics, I hope this will create some greater awareness of the journey our province has been on and how we've ended up at this moment. The big spoiler is: our energy system, significantly but not only because BC Hydro is publicly owned, has always been phenomenally political. It's just been a question of what priorities (e.g., building lots of gas production; or maintaining BC Hydro as a public entity) the government of the day has brought to it. That's probably not going to change, but a better understanding of its nuances will hopefully clarify that our energy system is not in a particularly unique crisis.

So, with that said, I will cover:

- What BC's energy system looks like today

- What some of the key terms and concepts are in the world of utilities and electricity specifically

- How our energy system has changed over the past 20 or so years, and how we have all evolved in our thinking of how much energy we would need, and for what

- How the introduction of climate policies like CleanBC has been a key factor in those changes

What You Need to Know

- 65% of all end-use energy consumption from BC is fulfilled by fossil fuels, mostly due to internal combustion engines, but also gas heating of buildings.

- Because of fossil fuels' inefficiencies, however, hundreds of petajoules of energy are lost along the way, leading many to project that we'll find energy savings along the way.

- As have most places, BC has a history of over-estimating energy demand (in 2004 BC Hydro estimated demand in 2024 would be 71,805 GWh - in actuality we only ended up using 54,259 GWh).

- With the BC Liberal's push for LNG, electricity estimates first rose dramatically (justifying building Site C), and then fell conspicuously as (1) the LNG dream faded, and (2) the NDP came in and wanted to pull back BC Hydro's spending.

- By the time climate policies like CleanBC got underway, no one wanted to talk about the need for more electricity, despite past projections for increased growth throughout the 2020s and 2030s due to industrial demand and climate action.

- As CleanBC unfolded, however, both old and new forecasts showing increasing energy needs confronted the now-comfortable belief that Site C would fulfill all or most of BC's needs for the foreseeable future. It would be with notable reluctance that many would come to agree on the need for more energy beyond Site C sooner, rather than later, by the early 2020s.

How BC Uses and Consumes Energy

Like most Canadian provinces, BC is a strange animal by global standards. We have a regulated energy market with both a major public (BC Hydro) and a private (FortisBC) energy provider, for electricity and gas respectively. There are other players but their size makes them almost irrelevant when put next to these two behemoths.

The conversation about energy in BC often is taken to be 1-to-1 with electricity, but it's important to remember that these are not the same. BC's total energy mix for all end uses – power, heating, industry, transportation – is much bigger and much different than the smaller picture for electricity.

I think of BC's energy system as having four key parts:

- Utility-provided electricity, almost all of which is hydro, with a little from gas, wind, and solar;

- Utility-provided heat (mostly via gas, but also steam, like through things like the downtown Vancouver Creative Energy plant);

- Consumer-accessible fuels or charging stations, mostly through gas stations and public- or home-based charging;

- Commercial and industrial-only fuels, including classic fossil fuels, biofuels and forest waste products like "hog fuel."

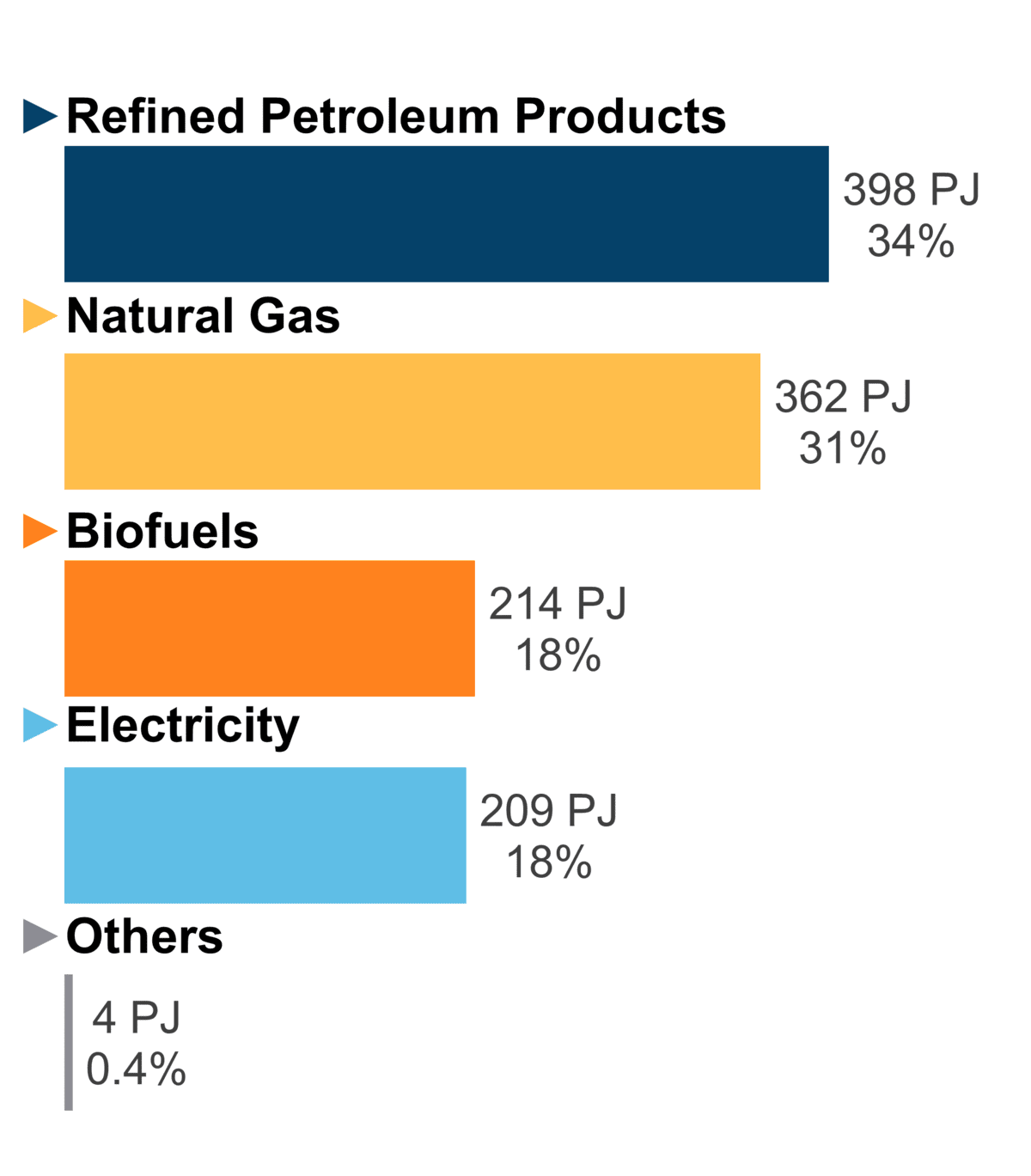

Supplied by these various delivery agents, after losses to inefficiency (the "end use") the Canadian Energy Regulator (CER) reported that BC used 1,187 petajoules (PJs) of energy in 2021, spread across different sectors:

- 48% of all energy is used by BC's massive industrial sector, including forestry, manufacturing, oil and gas, mining, and other specialized processes.

- 27% is used by the transportation system, including commercial and passenger (i.e., you and me) vehicles, rail, ferries, and so on.

- 14% is used by residential consumers to power, heat, and cool their homes.

- And 11% is used by commercial users to power, heat, and cool their facilities.

The CER also helpfully defines the end-use of fuels, too:

How we move things around and heat things today is quite energy-expensive (though, thankfully, this is changing), so, it's not surprising that fossil fuels still make up a great chunk of our energy system because of their density.

But as we know from Eyer's and RMI's work, they're also phenomenally inefficient. Looking at the numbers above, particularly the refined petroleum products used in transportation, these are generally "well-to-tank" numbers, meaning they represent the energy that's arrived (after losses during refinement and distribution) to be used in a vehicle or facility.

This is another way to say: when we received 398 PJs worth of refined petroleum products, those fuels had already lost a good deal of their energy during production and would further lose potential energy to waste heat and other inefficiencies once they were burned in vehicles or equipment.

If, as part of our decarbonization efforts, we look to electrify and otherwise increase the efficiency of our system, we can expect significant energy savings and, by extension, economic gains.

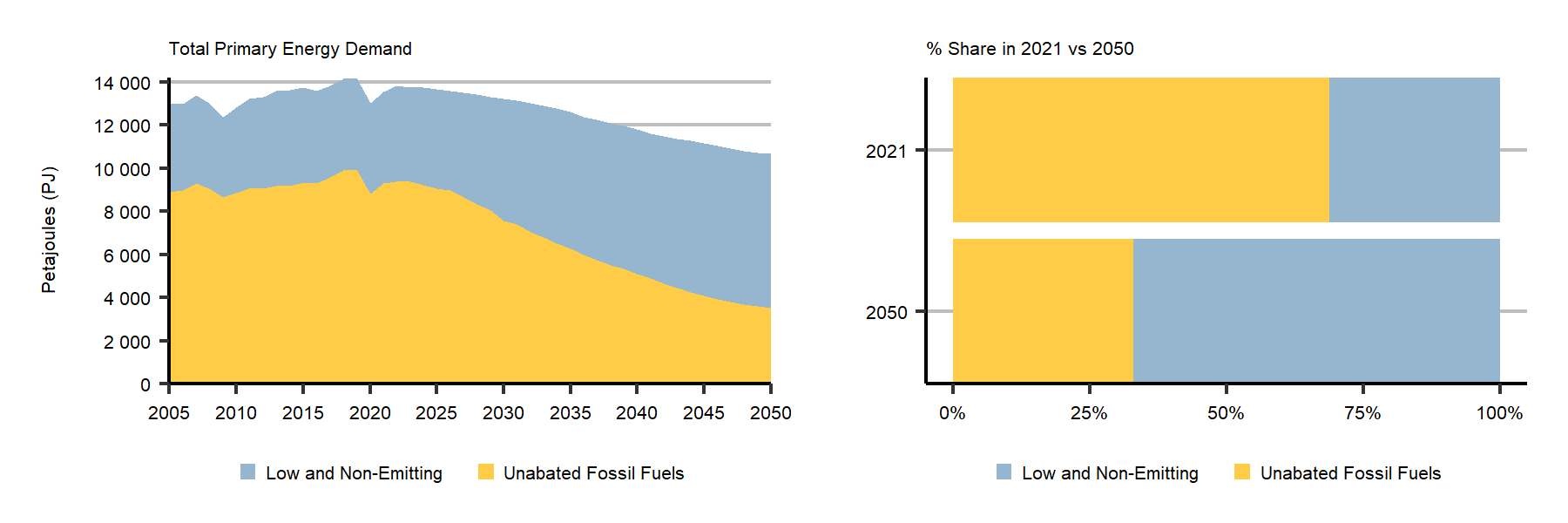

This is why the CER has estimated that Canada's total primary energy use may decline as much as 21% by 2050 if we pursue a high-electrification, "accelerated pathway" to decarbonization.

That possibility, however, comes down to questions of which pathway(s) we take in policy and, by extension, business and consumer decisions. Let's turn to that now.

Key Players and Concepts in BC's Energy System

Beyond its technical components, the BC energy system has a vast array of players that help shape it, but there are a few actors, laws, and concepts, that give it its basic shape.

Let's start with what we could call "the big three":

- The BC Utilities Commission (BCUC), governed by the Utilities Commission Act, is the regulatory body that says what all energy utilities (and a few other entities) can and cannot do. They enforce their Act, and follow, largely, what are called the "Bonbright Principles" of utility regulation, which are about fairness, transparency, stability, and effective distribution of costs.

- BC Hydro, the publicly-owned electricity utility, which owns and operates both generation (e.g., dams), transmission, and distribution infrastructure (i.e., the wires) to get electricity to you. It also has three subsidiaries: an electricity-trading company, Powerex; Powertech Labs, a performance-testing and certification group and facility; and an internal contracting arm, Columbia Hydro Constructors.

- FortisBC, formerly Terasen Gas, and before that BC Gas, which itself had purchased most of the Lower Mainland gas network from BC Hydro in the 1980s. FortisBC (and often "FEI" in official documents) is the private sector, investor-owned utility that (mostly) sells gas used for heating buildings and some industrial uses. Fortis' largest group is its gas division, but it also has electricity service in the Okanagan, and lastly has an Alternative Energy Services (AES) division that does one-off renewable energy projects.

With these players in hand, there are a few other concepts that are important to understand, too:

- BC has what's called a regulated energy market for electricity, where utilities own (in this case, Hydro 90% of the time and Fortis and others in a few spots) and operate the infrastructure from the point of generating energy (e.g., a dam) to where it's used (e.g., your home). Utilities in these markets must follow complex regulations designed to maintain stability and ensure fairness (especially for small and rural communities in places like BC).

- For the gas system, BC is a deregulated energy market, which means that customers can choose which gas provider they want to buy from, though there are some places where Fortis or another utility holds a true and total monopoly. De-regulated markets are complex and, if not overseen carefully, can result in market failures where no one wants to provide power at a critical time, like what happened in Texas and Alberta in 2021 and 2024.

- Integrated Resource Plans (IRPs) are what utilities use to lay out how they plan to generate or purchase, transmit, and directly deliver their energy to their customers, within the context of utility regulation and largely in alignment with the Bonbright Principles.

- Generation refers to the making of electricity, which can be transported to different locations to either do "work" (to move stuff mechanically or digitally), or heat things.

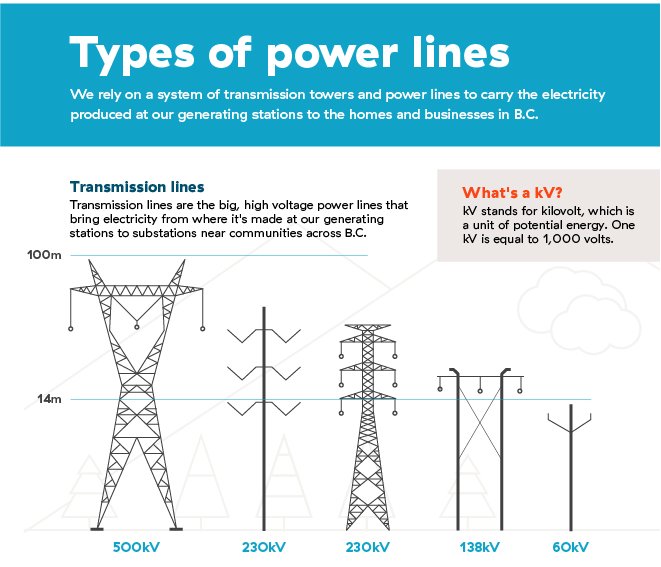

- Transmission is when the electricity that's been generated is pushed into the wires that make up the grid and transported to points in the network where it will be broken up into smaller intensities and distributed.

- Distribution is the final stage in electricity delivery where it is taken from bigger, higher-voltage transmission lines, and decreased in voltage into the smaller power-poles we're used to, where it can be brought directly to commercial and residential consumers at their point of use.

These next two concepts intermingle the technical and the human, but they're incredibly important:

- Utilities will refer to the capacity of their resources (i.e., their sources of energy) to create power, which means the maximum output, expressed in Megawatts (MW). This is also referred to as "nameplate" generator capacity, which means the optimal output of their systems under ideal conditions.

- Confusingly, energy is also used as a term of art to refer to the total amount of (generally electricity) that is created over the course of a set period of time. This is measured in kilowatt hours (kWh), megawatt hours (MWh), gigawatt hours (GWh), and terawatt hours. In 2020, BC's industrial sector consumed 23.3 TWh of electricity, and in 2021 we generated 71.7 TWh.

With these concepts in mind, you're ready to dive into the energy system.

The Recent History of BC Energy Policy

While CleanBC and its roadmap to 2030 are the most recent, and therefore the most relevant, policy related to (but not solely about!) electrification and clean energy in BC, they are not the first.

There's an apocryphal story of then-Premier Gordon Campbell bringing a series of books on climate change to his annual vacation in Hawai'i in 2006 (the year An Inconvenient Truth and the Stern Review on the Economics of Climate Change both came out), and then, well, the rest is history. As Marc Lee writes in a 2017 retrospective,

[T]he 2007 Speech from the Throne talked about climate change at length and announced a host of new measures. Coal-fired electricity was essentially killed by a requirement that plants have 100 per cent carbon sequestration. The Speech covered methane capture in landfills, electrification of ports and truck stops, new standards for cars and gas, a green building code plus retrofits for existing buildings, green cities, and tree planting.

There was a flurry of activity after this, though, as Lee writes, the commitment waned fairly steadily afterward. Where there was some of the most activity, though, was around energy.

Building on a prior expert task force and the already existing Open Call for Power from BC Hydro, 2007 saw the release of the BC Energy Plan, which created a "vision for clean energy leadership" for BC and set a goal of "energy self-sufficiency" by 2016. The plan is light on numbers, but there is a notable mention in the electricity security section, where they reference a BC Hydro estimate of a potential 45% growth in electricity usage over the next 20 years (which was repeated fairly often in documents around this time).

The Energy Plan made a lot of headlines, but it wasn't until 2013 that BC Hydro's next Integrated Resource Plan was released and the vision became further instantiated. It built on the 2004 and 2006 Integrated Electricity Plans and the demand-supply outlook (i.e., forecast) it had made. It's worth going back to track the evolution of our thinking on how much power we needed - and for what.

In 2004, they expected BC Hydro's gross electricity needs to grow from 53,050 GWh in 2003 to 71,805 GWh in 2023.

The Challenges and Choices report, summarizing some of the 2007 plan and acting as a public relations document for BC Hydro and the government navigating the BC Utilities Commission process, reinforced this story.

The 2019 report, Zapped: A Review of BC Hydro’s Purchase of Power from Independent Power Producers, notes that after the 2007 plan, BC energy policy became both considerably more politically motivated and therefore more government-led. Thanks to the 2010 Clean Energy Act (CEA), the BCUC's role as a regulator was constrained and major decisions, such as those related to mega-projects like Site C, were relegated to government planning in favour of both their clean energy objectives and, increasingly, the development of a BC-based liquified natural gas (LNG) industry.

The NarwhalAinslie Cruickshank

The NarwhalAinslie Cruickshank

The 2013 Integrated Resource Plan (IRP) plays out that thinking with its continued insistence on the development of independent power producers (IPPs) through the standing offers program (SOP), and the strong emphasis on LNG. As their load-resource balance estimate said:

BC Hydro’s current estimate suggests the LNG industry could need in the range of 22 800 to 6,600 GWh/year (100 to 800 MW [that's capacity]), with an expected LNG load of 23 approximately 3,000 GWh/year and 360 MW by F2022.

And they accordingly baked that into the load forecasts.

And included specific ranges for the included LNG in terms of both the energy load and peak demand forecast:

And, notably, started to show some specific sector-by-sector breakdowns in light climate action and other work in different sectors:

After 2013, there wasn't another large energy plan from BC Hydro until 2021, an almost 10-year gap.

These years were largely defined by fights over independent power producers and the gargantuan battle, which to some extent still simmers, around Site C.

This 1,100 MW dam had originally been proposed in the 1950s, had been panned in the 1980s as too expensive and unnecessary, and was revived and championed by Christy Clark's government to support the LNG sector.

Despite its direct and political motivation and significance, the government (and BC Hydro, by extension) still had to do some work to prove the need for the project. They would spend much of the 2010s fighting over spreadsheets and economic assumptions with the environmental and energy communities to do so.

The Demand Debates

The Program on Water Governance did an excellent submission as part of the Site C review process, reviewing the economics of the project and offering a broader critique of BC energy policy (or, as they sometimes say, lack thereof). They effectively pan on the need for the project, saying it would be better to suspend it and wait and engage with the BC Utilities Commission processes (which Site C had been exempted from) and see where energy demand in BC headed before building any more generation. I believe they rightly call out the then-Clark Government's focus on the dam as tied to LNG, even as they miss the mark a few times on their broader thinking on future energy demands due to climate action.

Fundamentally, the Hendriks, Raphals, and Bakker paper offers a critique of what they seem to view as BC and BC Hydro's culture of overestimating future electricity demand. As they write:

Since 1992, when BC Hydro began producing annual forecasts, 89.5% of the utility’s mid-load projections were overestimates [to be fair to Hydro, they're in line with most other utilities in doing so]. These estimates in fact could be better described as a high-load forecast, defined as a forecast that is expected to exceed actual future requirements 90% of the time. In its submissions to the BCUC in support of the Site C Project in 1981, BC Hydro’s “probable” or “mid-load” forecast predicted that system-wide energy demand would increase from 31,450 GWh/year in F1981 to 90,000 GWh by F2002, net of conservation.

In particular, they critique 1992 to 2008 forecasts, which they similarly show significantly over-assume future energy needs.

The 2000 to 2005 forecasts they deem more realistic, but still with a consistent over-emphasis on the need for new generation capacity, which the authors argue has consistently been met through demand-side management (DSM) interventions that increase efficiency across the system and reduce the need for generation.

They also review a component of the 2013 IRP, which had a special report on electrification and climate action by Mark Jaccard and several colleagues (the "MKJA study"). The study, conducted by the former and (as of 2024) current head of the BCUC, is comprehensive and fascinating to read, but its key takeaways were that if BC pursued even a moderately aggressive climate agenda, significant electrification would be needed, but not in any significant way until after 2030.

As the Water Governance team summarizes that special report from Mark Jaccard and Associates:

[The MKJA study concludes that,] based on BC Hydro’s domestic billed sales of about 50 TWh/year in 2010, [a possible] increase in electricity requirements including electrification could range from 31% to 69% by 2030 and from 49% to 120% by 2050. Under medium GHG and medium natural gas prices, the increases are 45% by 2030 and 86% by 2050. The MKJA study also conducted a sensitivity analysis that concluded that lower-cost electric vehicle batteries increase electrification by an additional 15 TWh/year. Taken together, these findings suggest that deep reductions in British Columbia’s GHG emissions result in substantially more electricity demand.

These are very large numbers, and it's important to put them in the context of Site C, which was set to increase Hydro's generation capacity by about 9% by 2025.

In general, they seem to have more faith in the BC-specific work of the MKJA study but take it to task for (1) assumptions about future high carbon prices, (2) lower gas costs than projected, and (3) higher estimates of EV demand. These three assumptions they say are aspects of the model that drive the significant net energy demand increases in 2030 and 2050.

Interestingly, however, in citing the BC Hydro 2016 Revenue Requirements Application (RRA), which assumed far lower EV demand than the MJKA study, it seems everyone was wrong:

Because of the drop in EV costs, as shown by Bloomberg New Energy Finance recently and our strong EV-related policies and incentives, BC more than tripled the expected sales for EVs that the MJKA study (which was felt to be optimistic) predicted in 2012. More specifically, in 2023 the BC Government reported that "the number of registered light-duty EVs in B.C. rose from 5,000 in 2016 to more than 129,500 today, an increase of 2,500%."

This is an indication of just how complex and, in some respects, how pessimistic some projections were for how quickly decarbonization could occur - and how much electricity it might require.BC Hydro's 2014, 2017, and 2019 Revenue Requirements Applications (RRAs), and the Site C process, all operated within the limited BCUC oversight context established by the 2010 Clean Energy Act, but still put forward forecasts.

The 2012 Load Forecast was leaned upon heavily in the Site C Business Case, was drawn on to argued that "electricity demand in B.C. will increase by approximately 40 per cent over the next 20 years, excluding any load from LNG facilities and before accounting for DSM. Load from new LNG facilities that may request service from BC Hydro would further increase this load."

They were estimating energy generation and peak capacity needs with average annual growth rates between 1% and 1.2%.

The 2017 Revenue Requirement Application follows the same pattern, with further increases in generation needed after 2019.

It's interesting to read the submission since perhaps drawing on the assumptions of the prior MJKA study, it estimates further EV demand rising into the 2030s:

Electric vehicle demand is projected to be under 50 GWh per year and estimated total number of electric vehicles (i.e., total stock) is about 6,000 in fiscal 2017 and about 11,000 in fiscal 2019. Beyond the test years, electric vehicle load is forecast to be about 70 GWh per year in fiscal 2022, about 430 GWh per year in fiscal 2027 and 1,760 GWh per year by fiscal 2036. The forecast of the total number of electric vehicles is about 30,000 in fiscal 2022, about 164,000 in fiscal 2027 and about 580,000 in fiscal 2036.

For context, and to the continuing surprise of many, in 2023 there were more than 150,000 EVs on the road in BC, with final sales at 20.2% of all vehicles, and more than 25% when you include hybrids. This is to say that back then, and still to this day, we continue to underestimate the demand for EVs.

A New Government, a New Paradigm: Enter CleanBC

After the 2017 RRA, things really start to get interesting. In 2019, the newly elected NDP Government, supported through the Confidence and Supply Agreement (CASA) with the Greens, released CleanBC.

Despite the fanfare at finally having a climate plan, there was also considerable consternation as the fights over Site C continued, and BC Hydro underwent a major review regarding the eye-watering costs of both the big damn and the legacy independent power producer contracts.

After the completion of Phase 1 of the BC Hydro Review in 2019, the arcane machinery of the BCUC was once again mobilized: BC Hydro would need to create a new IRP by 2021.

But in the meantime, BC Hydro pursued their 2018 and 19 RRAs and, deliciously, included a 20-year forecast, largely developed in 2018 and then carried forward in 2019. In their understated, they wrote that:

The Total Integrated (mid) June 2019 System Peak Forecast after Demand-Side Management (DSM) savings expects growth in peak demand of approximately 1.0 per cent per year over the next 20 years.

People often balk at this seemingly modest estimate of the growth in energy needs after the release of CleanBC, but it is important to state that, given how much energy we're already talking about (11,000~ MWh of peak demand), a 1% gain per year (after efficiency investments) still means some considerable amounts of generation are needed in raw terms - and this was in line with the last estimates used in the Site C Business Case.

Nevertheless, a new round of fights over energy forecasts began:

Clean Energy BC, the provincial industry association for independent power producers, came out with some significant criticisms of BC Hydro and the Government's projections. They created a white paper at the end of 2018 to line up with the release of CleanBC, and justify, in part, the private electricity industry's role in BC's forward-looking climate plans.

The paper is bold - and it raised real hackles at the time, given how much it implied the BC Government was off in its estimates. As they wrote:

This paper shows that extensive electrification could reduce LNG industry emissions up to 72 percent, natural gas production emissions up to 60 percent, trucks and trucking up to 84 percent, and residential and commercial building heating by up to 98 percent. Extensive electrification would enable BC to meet our climate targets and would require increasing BC’s production of renewable energy by as much as 50% to meet the 2030 GHG targets, and by as much as 100% to meet the 2050 targets. [emphasis added]

This is a far cry from the 1% growth per year estimated in the 2018/2019 RRA.

Now, many people justifiably said that an industry association was pushing for its place in the sun as part of the government's new policy agenda – of course an electricity generation industry association would say we need more electricity! But their thinking, while having its flaws, wasn't completely out to lunch, either.

They get fairly specific, going deep into three key sectors to show the total increased electricity demand in a high-electrification scenario to deliver CleanBC.

Firstly, they talk about the electrifying industry, which they see as inclusive of forestry, mining, and manufacturing (21% of BC's GHGs), fossil fuel production, including coal, oil, gas, and LNG (19%), and electricity production (1%). Because of the uncertainty of LNG, they really focus on high-level potentials that come from significant electrification and not necessarily specific projects.

As their last scenario indicates, a significant LNG presence in BC could mean as high as a 72.4% increase in the need for electricity above the 2017 projections.

They then go into the transportation sector and use a very aggressive electrification scenario, drawing on work from Curran Crawford at the University of Victoria, wherein all segments of the transportation sector reach 99% electric vehicle sales by 2032. (Notably, this is out of step with our current policy, which will only have 100% light-duty sales by 2035 and, possibly, a similar mandate for medium and heavy-duty vehicles if the 2023 consultation paper on the subject becomes regulation).

Compared to the MKJA analysis, which, in a medium carbon price and low battery-price scenario, estimated that BC would need approximately 3.6 TWh/year in 2030 for EVs, they were estimating over double.

Buildings represented a less dramatic story, but still a meaningful increase of 21% above 2017 levels.

The Clean Energy BC paper faced a lot of pushback from the government and other experts, but, at least in my circles, it did spark considerable conversation in some about the relative balance of energy needed. And it wasn't the only one: academics at UBC, SFU, and elsewhere also began to chime in with other views of what the future demand for energy would look like.

Whether or not a 100% increase by 2050 was realistic, it identified a need to be bolder and more holistic in how we thought about what climate action was going to demand of us in terms of electrification.

Who Was Right?

I think most people leave this conversation – justifiably – with a "so what?" We debated our energy future, including demand and supply, endlessly and basically everyone was wrong at one point or another. I think a lot of people are looking for a "smoking gun" in terms of who was most wrong, or who set us on an improper course. As I read through the innumerable plans, estimates, policies, injections, projections, and commentaries, I came to a few high-level conclusions that have helped me navigate, and I hope may help you, too, energy conversations in BC more effectively:

- Energy is always political, and the assumptions we make around it are always reflective of our values. People, in short, often saw what they wanted to see: The BC Liberals loved Site C because it was, in part, a symbol of the kind of big economy they wanted to build, which needed to include LNG. The NDP and Greens wanted a credible climate plan, but, stuck with the albatross of the over-budget dam, were trying to show that their (needed) push on climate action wouldn't disrupt the existing system.

- Few people take an integrated view of the energy system. Many of the commentators on the need or not for Site C and other projects often either significantly overestimated the opportunities for efficiencies (or some types of renewable energy), or fell directly into the primary energy fallacy.

- The opportunities for an electrified economy were significantly underestimated. Even old hands like Marc Jaccard underestimated demand for EVs dramatically as costs continued to fall - future opportunities in building electrification and otherwise may yet also be still understated.

The boring, hard reality of all of this is that no one had a crystal ball, but almost everyone operated with considerable optimism that their best-case scenario would be right. The trick for navigating the energy transition, in my view, will be to operate more on the basis of bad-to-worst-case scenarios not only for energy demand but also for the needs and impacts of climate change. Merging these views will enhance our understanding of the brutalizing costs of inaction on climate change, the real challenges and needed investments as part of the energy transition and, as I said in part one, the tools we have as citizens and society to shape that transition for our mutual benefit.

Hard doesn't mean impossible, and nor, if you've ever climbed a mountain, does it mean the effort isn't worth it.

In the next article, we'll talk about the responses to what has now become the recognition of our increased demands for electricity, not only as a result of CleanBC, but a broader industrial reformation and growth that has occurred, and will hopefully continue, over the next decade.

Sign up for George Patrick Richard Benson

Strategist, writer, and researcher.

No spam. Unsubscribe anytime.